Grade A office net absorption slumps to 167,100 sqft in Q1

Banks and co-working facilities hit the brakes on their expansion plans.

Multinational corporations (MNCs) are expected to retain a cautious approach towards their real estate requirements in the near-term future amidst sluggish leasing activity in Q1 2019, which registered 167,100 sqft, according to according to the CBRE’s Grade A office market review.

The headline figure represents just 5.7% of the annual total in 2018,although an estimated 65% of net absorption in Q1 2019 was contributed by pre-commitments in new projects.

That said, the volume of leasing transactions by banking and finance firms contracted 70% QoQ, with Q1 2019’s total accounting for just 6% of the sector’s leasing activity in 2018. Expansion by flexible space operators also slowed during the quarter, committing just 39,300 sqft of Grade A office space.

Two new Grade A offices providing a total of 663,500 sqft were completed during the quarter, which helped support leasing activity in the primary market amidst continued low vacancy. Overall, vacancy edged up 0.6% QoQ to 5.2%.

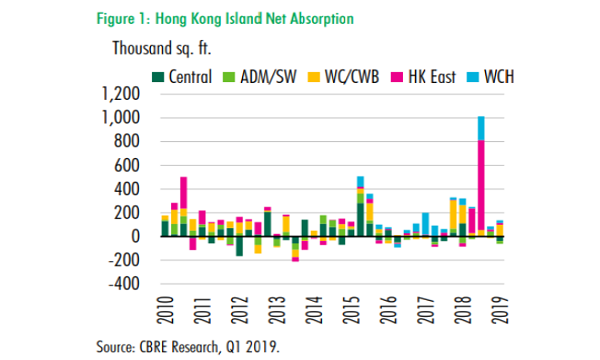

Net absorption on Hong Kong Island stood at 18,600 sqft, which is lower than the 70,600 sqft seen in the previous quarter.

“In Greater Central, several large units were returned to the market following the expiry of existing lease. The absence of solid expansionary demand ensured net absorption in this submarket registered -61,800 sqft,” the authors noted, adding that the vacancy rate in Greater Central remained relatively low at 1.5%.

Major transactions in Q1 2019 stemmed from Chinese firms with an existing presence in Hong Kong rather than by new entrants, such as the in-house expansion of Aevitas Securities in Cheung Kong Centre from 4,000 sqft to 13,000 sqft. That said, gross leasing activity in Greater Central by Chinese companies remained sluggish as it demand shrank 48% QoQ to 62,200 sqft.

Weaker leasing demand therefore translated to slower rental growth on Hong Kong Island in Q1 2019. Rents inched up 0.2% QoQ, which is said to be the slowest quarterly growth since Q3 2014. Rents in Hong Kong East and Wong Chuk Hang continued to record steady growth of 1.2% and 1.1% QoQ, respectively.

Decentralisation slumps

Decentralisation activity also slowed amidst the low vacancy in non-core areas. Major deals included Chinese wealth management firm Noah Holdings’ leasing of an entire 15,600 sqft floor in Tower 2 of Times Square and personal care products retailer L’Occitane which reportedly pre-leased space in K11 Atelier King’s Road to relocate from Causeway Bay.

Leasing demand in Kowloon and the New Territories held steady in Q1 2019, with net absorption recorded at 148,500 sqft.

“Despite new take up in Kowloon East and Tsim Sha Tsui, higher vacancy pulled down net absorption in these two submarkets to a marginally positive level,” the report’s authors explained. “Moreover, the completion of NEO in Kowloon East pushed up vacancy in this submarket by 2.6 percentage points (pp) to 13.5%, whilst vacancy in Tsim Sha Tsui was stable at 2.5%.”

According to the report, Kowloon continued to receive decentralisation demand from core locations, particularly from professional services firms.

Major deals included Sun Life Assurance’s move from Tsim Sha Tsui to 133,000 sqft in both Tower A and Tower B of Cheung Kei Centre in Hung Hom. Several Hong Kong Island-based occupiers also opted to relocate across the harbour in Q1 2019, such as French market research firm IPSOS which relocated from Causeway Bay to a 15,000 sqft space in China Life Centre in Hung Hom.

Softer leasing demand, coupled with the ongoing decentralisation trend, dragged down rental growth by 2% QoQ in Greater Tsim Sha Tsui.

However, relocation demand from core locations helped to boost rents in Kowloon East and Kowloon Others, the report’s authors highlighted. Rental growth in Kowloon East accelerated from 0.8% QoQ in Q4 2018 to 1.7% in Q1 2019, whilst Kowloon Others reported an increase of 1.6% QoQ.

“Sizeable occupiers are expected to become more flexible towards adopting innovative workplace strategies,” the authors added. “As more leading companies across sectors choose to decentralise, industry agglomerations in non-core locations will gradually emerge. Companies with lease expires coming up will likely be more willing to evaluate the feasibility of decentralisation, whilst some others may consider adopting a hybrid approach featuring a combination of agile workplaces and decentralised office space in order to reduce rental expenditure.”

Demand from Chinese firms is expected to remain soft in Q2 2019, as capital controls continue to affect Chinese firms’ ability to pay high rents, as well as undermined the sustainability of companies’ operations in Hong Kong.

Advertise

Advertise