Hong Kong's economy slumped 1.3% in Q4 2018: report

This was the slowest pace of GDP growth since 2016.

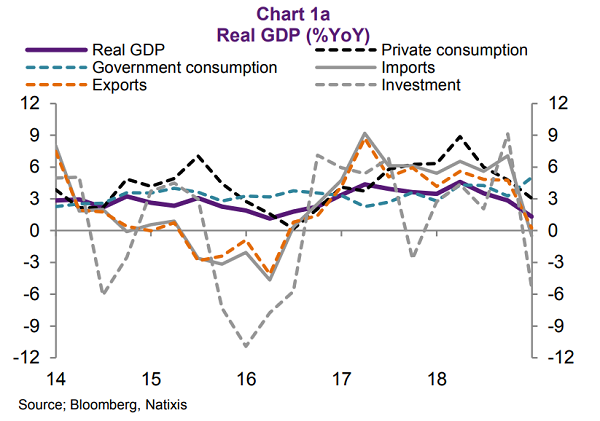

Hong Kong’s gross domestic product (GDP) growth slumped further to 1.3% YoY in Q4 2018 from an already weak base of 2.9% YoY in Q3, according to a report by Natixis.

The drag, which was registered as the slowest pace of growth since 2016, was primarily attributed to sluggish global demand and ongoing US-China trade conflicts. Private consumption reportedly remained as the country’s lone bright spot, remaining resilient amidst moderation in Q4.

“Export was still marching on the downward trend in Q4 2018, causing the trade deficit to widen. There seems to be some reversal in the external sector in January 2019 with a narrowing trade deficit but it might only be due to seasonal factors related to the Chinese New Year,” the report’s authors noted. Exports weakened to 0.3% in Q4 in slower global economic expansion, whilst the total export of goods decelerated in 2018 at 3.5%. Exports of services on the other hand, edged up 4.9%.

“On a positive side, inbound visitors arrival continued to record robust growth for 2018 but not enough to compensate for the trade deficit,” they noted.

Whilst the economy decelerated, Hong Kong’s labor market was observed to have remained resilient, with the unemployment rate staying at a low level amidst a slight decline in 2018. “Total employment grew solidly even at a level close to full-employment with sustained nominal wage growth,” the authors added said, adding that the sustained wage growth may support consumer spending and saving in the medium term.

During 2018, inflation went up to 2.4% from 1.5% in 2017. That being said, January’s headline CPI remained stable whilst dipping slightly to 2.4% due to lower cost of clothing, footwear, rentals and the government's provision of an electricity charge subsidy.

In the retail sector, sales dragged further in Q4 due to cautious consumption sentiments amidst moderating economic growth. In 2018 however, retail sales value rose 8.8%. “Going forward, external uncertainties and asset market volatilities should be closely monitored, but we expect favourable labour market conditions and robust inbound tourism should support retail growth in the future.”

Meanwhile, the earlier normalisation of US monetary policy led to a tightened monetary stance in Hong Kong towards end-2018, shown by the upswing of Hong Kong Interbank Offered Rate (HIBOR). Total loans were observed to have decelerated in 2018 under the influence of moderating economic growth and weaker loan demand.

“However, with a more dovish FED since end-January and the related improvement in global liquidity, the upward trend of interest rate came to a halt in early 2019 as HIBOR decreased significantly. On the back of a widening interest rate spread between LIBOR and HIBOR, the Hong Kong dollar has weakened against USD, touching the weakest convertibility rate and triggering the Hong Kong Monetary Authority (HKMA) to intervene in the currency market again in March 2019,” the authors highlighted.

Advertise

Advertise