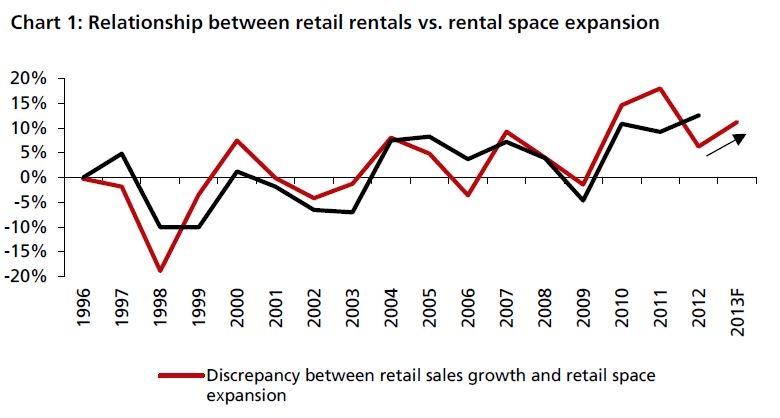

This graph shows the real deal behind the surge in retail rents

Commercial space stock only grew 1.8%.

According to DBS, the Consumer Council published interesting results in its 2012 annual supermarket price survey, which covers a basket of 200 items at three major supermarket chains in Hong Kong.

Overall prices rose 6.8% on average in 2012 over 2011, much higher than the 4.1% yearly CPI reading. Prices of baby milk powder/baby products and canned soup recorded double-digit growth rates.

Here's more from DBS:

Consumers can decide for themselves which is a more accurate measure of actual inflation. Inflation is a nagging problem in Hong Kong. Commercial rentals - shopping

centers and the like - will continue to inflate and extra costs will be passed on to consumers.Since 2004 (the Individual Visits Scheme was introduced in July 2003), retail sales volumes grew 8.5% on average per year. The stock of commercial space, however, only rose 1.8% on average in the same period.

Discrepancies between the growth of retail sales and retail space helped explain the surge of retail rents in recent years.

Going forward, demand-supply imbalances will remain. Retail space is estimated to increase only 5.4 million sq ft over 2012-2016 compared to 6.2 million sq ft over 2007-2011, according to Jones Lang LaSalle.

Retail sales volume, on the other hand, will grow steadily on the back of China’s recovery and a resilient local labor market. In 2013, retail sales volumes are projected to grow at least 12% YoY (2012: +7.5%). It seems like inflation will be with us for some time more.

Advertise

Advertise