Here's how economy will probably look like in 2013

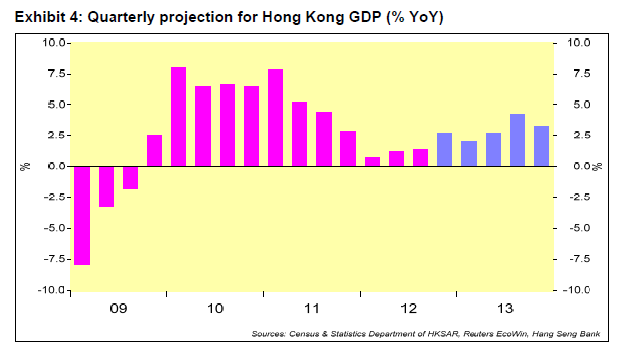

The quarterly growth trajectory would be similar to what happened in 2012.

Hang Seng Bank sees the economy to have a slow start and gradually gaining traction from 2Q13.

Here's more from hang Seng Bank:

Enthusiasm about Hong Kong’s growth prospects is rising again. Yet within the context of a longawaited cyclical recovery, there are numerous structural barriers that will set the tone for overall economic performance.

The ongoing deleveraging process will keep most of the industrialised economies in tough condition. Uncertainty arising from the Troika review in Greece, a potential bailout plan for Spain as well as the 2013 budget sessions could loom and hamper hiring and investment decisions.

In many aspects, the economic outlook of 2013 looks familiar to the second half of 2012. The outlook hinges to a large extent on developments in Europe and US.

Developed economies will continue to struggle to deal with the legacy of precrisis imbalances, but we judge that the upcoming risk events would be resolved gradually over time. The shift to fiscal austerity will present new headwinds but will not uproot the recovery.

Marginal improvements in exports and steady consumption will serve to lift Hong Kong’s GDP growth to 3%1 in 2013, from an estimated 1.5% in 2012 but still below its long-run potential growth of around 4.5%.

Advertise

Advertise