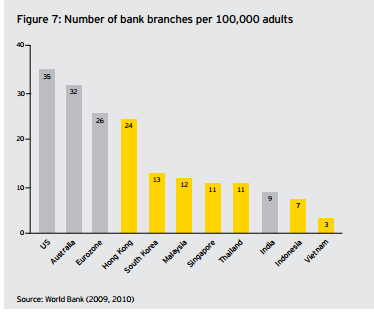

Here's how underdeveloped Asia's financial services are

Hong Kong only has 24 bank branches for every 100K adults.

US has 35 per 100K adults.

Just imagine how much less the proportions are in other countries. Check out the graph at the right corner.

According to Ernst & Young, the expanding middle class will create demand for a wide variety of financial services. As incomes grow, so too will the demand for sophisticated services such as investment advice, pensions and personal insurance. For example, 21.8 million people in China, it said, had credit cards in 1997; this number rose to 285 million by 2011.

Further, E&Y notes that as financial services tend to have higher income elasticity than, say, agricultural and manufactured products, sectors such as wholesale and retail trade, real estate, education, health care and social security are all likely to benefit.

"In general, the financial industry remains underdeveloped in many of Asia-Pacific’s Rapit Growth Markets. Therefore, the demand for financial services in Asia-Pacific is likely to rise faster than in highincome countries," it said.

Advertise

Advertise